Many employee benefits are subject to annual dollar limits that are adjusted for inflation by the IRS each year. The following commonly offered employee benefits are subject to these limits:

High deductible health plans (HDHPs) and health savings accounts (HSAs);

Health flexible spending accounts (FSAs);

401(k) plans; and

Transportation fringe benefit plans.

The IRS typically announces the dollar limits that will apply for the next calendar year well before the beginning of that year. This gives employers time to update their plan designs and make sure their plan administration is consistent with the new limits.

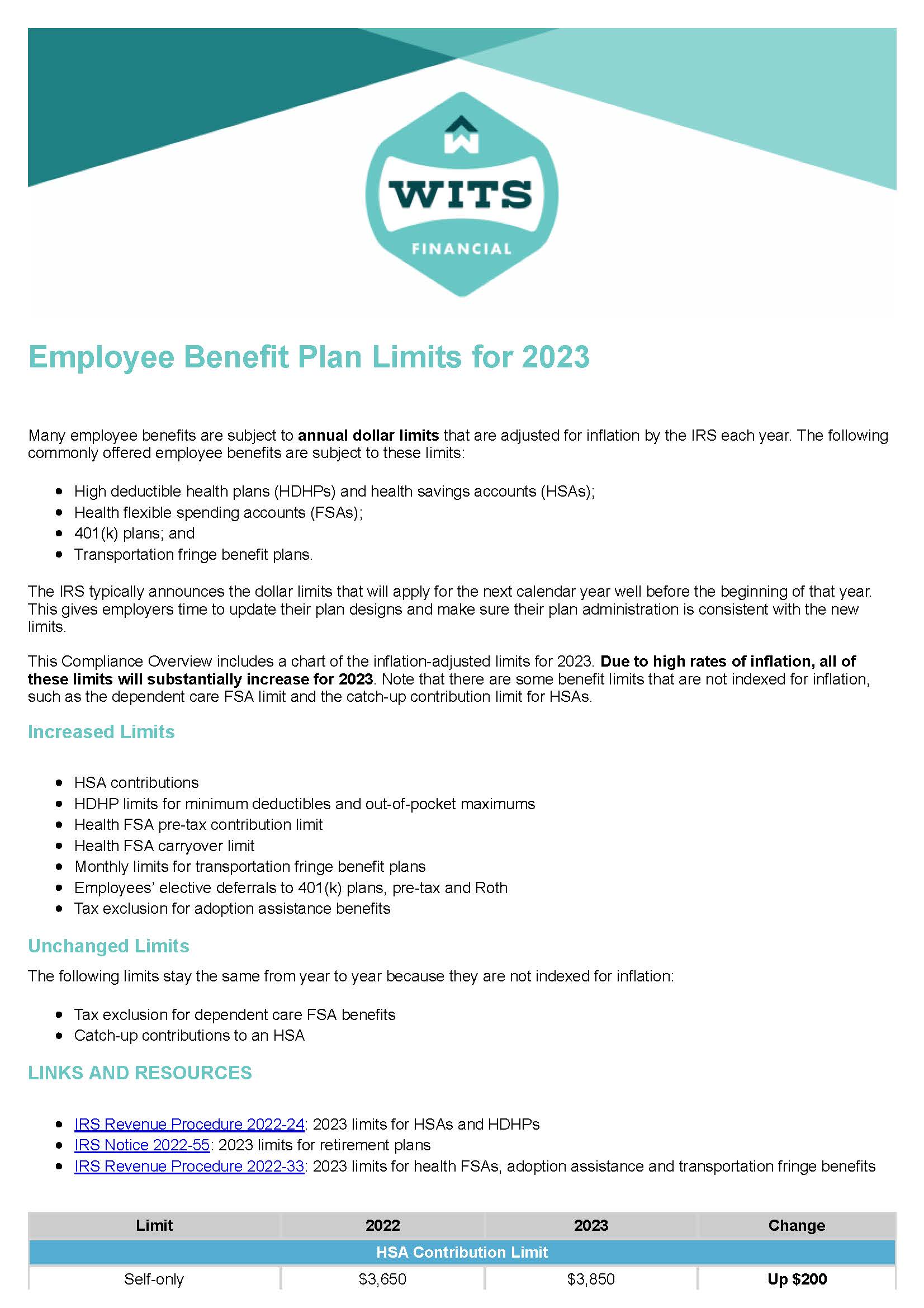

This Compliance Overview includes a chart of the inflation-adjusted limits for 2023. Due to high rates of inflation, all of these limits will substantially increase for 2023. Note that there are some benefit limits that are not indexed for inflation, such as the dependent care FSA limit and the catch-up contribution limit for HSAs.

We Make it Easy

Let us take the stress out of managing employee benefits.

Schedule a Call

We’ll ask a few questions, review your current benefits and determine your goals.

Let us Do the Leg Work

Based on your needs and budget, we’ll research all available options and help you select the right plan for your employees and your business.

Bask in the Glory

When you’re confident due diligence has been done, and you’ve selected the right plan it’s time to sit back and relax - or get to everything else on your list.