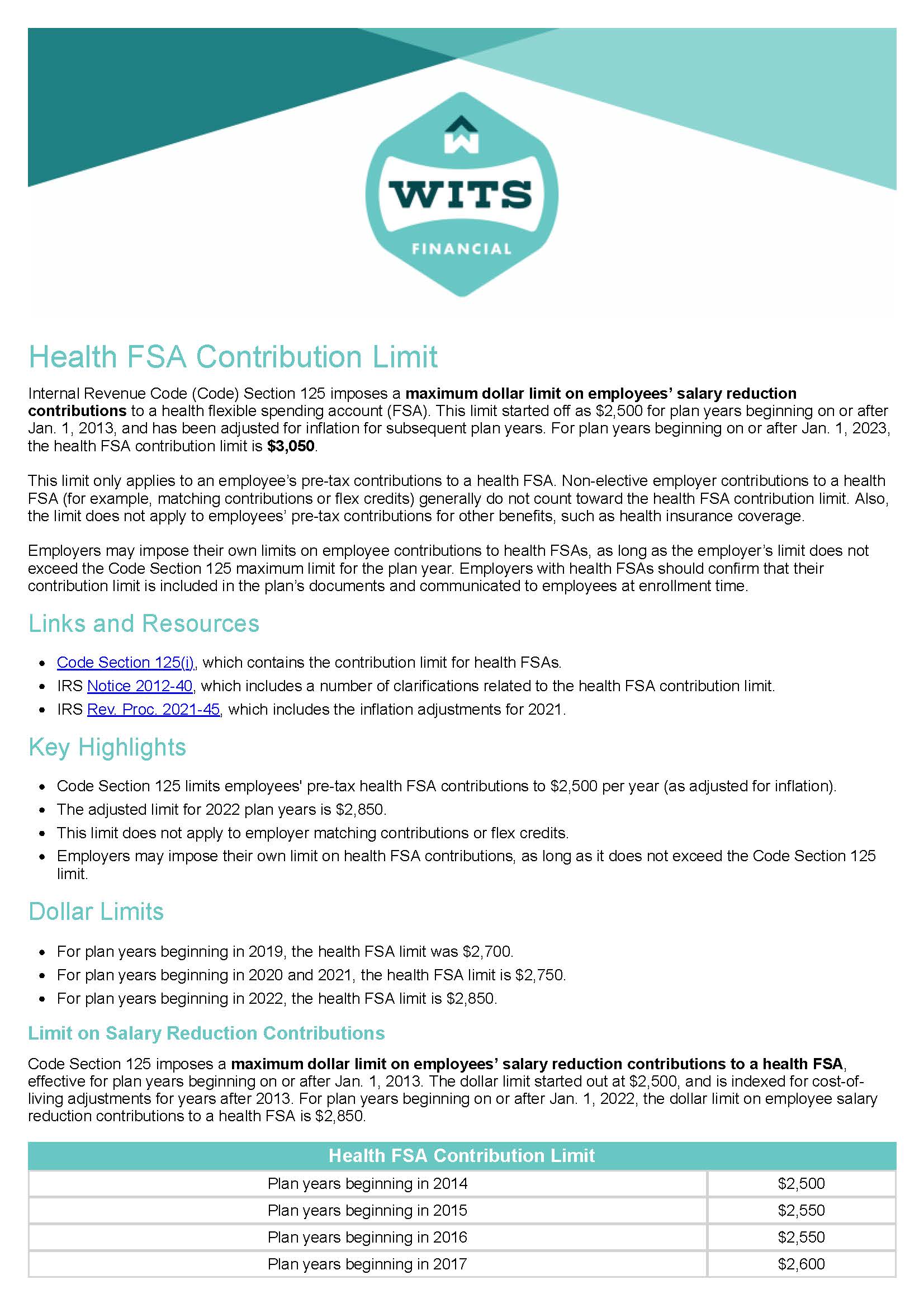

Internal Revenue Code (Code) Section 125 imposes a maximum dollar limit on employees’ salary reduction contributions to a health flexible spending account (FSA). This limit started off as $2,500 for plan years beginning on or after Jan. 1, 2013, and has been adjusted for inflation for subsequent plan years. For plan years beginning on or after Jan. 1, 2023, the health FSA contribution limit is $3,050.

This limit only applies to an employee’s pre-tax contributions to a health FSA. Non-elective employer contributions to a health FSA (for example, matching contributions or flex credits) generally do not count toward the health FSA contribution limit. Also, the limit does not apply to employees’ pre-tax contributions for other benefits, such as health insurance coverage.

Employers may impose their own limits on employee contributions to health FSAs, as long as the employer’s limit does not exceed the Code Section 125 maximum limit for the plan year. Employers with health FSAs should confirm that their contribution limit is included in the plan’s documents and communicated to employees at enrollment time.

We Make it Easy

Let us take the stress out of managing employee benefits.

Schedule a Call

We’ll ask a few questions, review your current benefits and determine your goals.

Let us Do the Leg Work

Based on your needs and budget, we’ll research all available options and help you select the right plan for your employees and your business.

Bask in the Glory

When you’re confident due diligence has been done, and you’ve selected the right plan it’s time to sit back and relax - or get to everything else on your list.