Federal tax law imposes strict limits on how much can be contributed to a health savings account (HSA) each year. The maximum contribution limit generally depends on whether an HSA-eligible individual has self-only or family coverage under ahigh deductible health plan (HDHP). Individuals who are age 55 or older by the end of the tax year are permitted to make an additional $1,000 HSA contribution, called a “catch-up contribution.”

There is a special contribution limit for married individuals, which provides that if either spouse has family HDHP coverage, then both spouses are treated as having only that family coverage. This means that if both spouses are HSA-eligible and either one has family HDHP coverage, the spouses’ combined contribution limit is the annual maximum limit for individuals with family HDHP coverage.

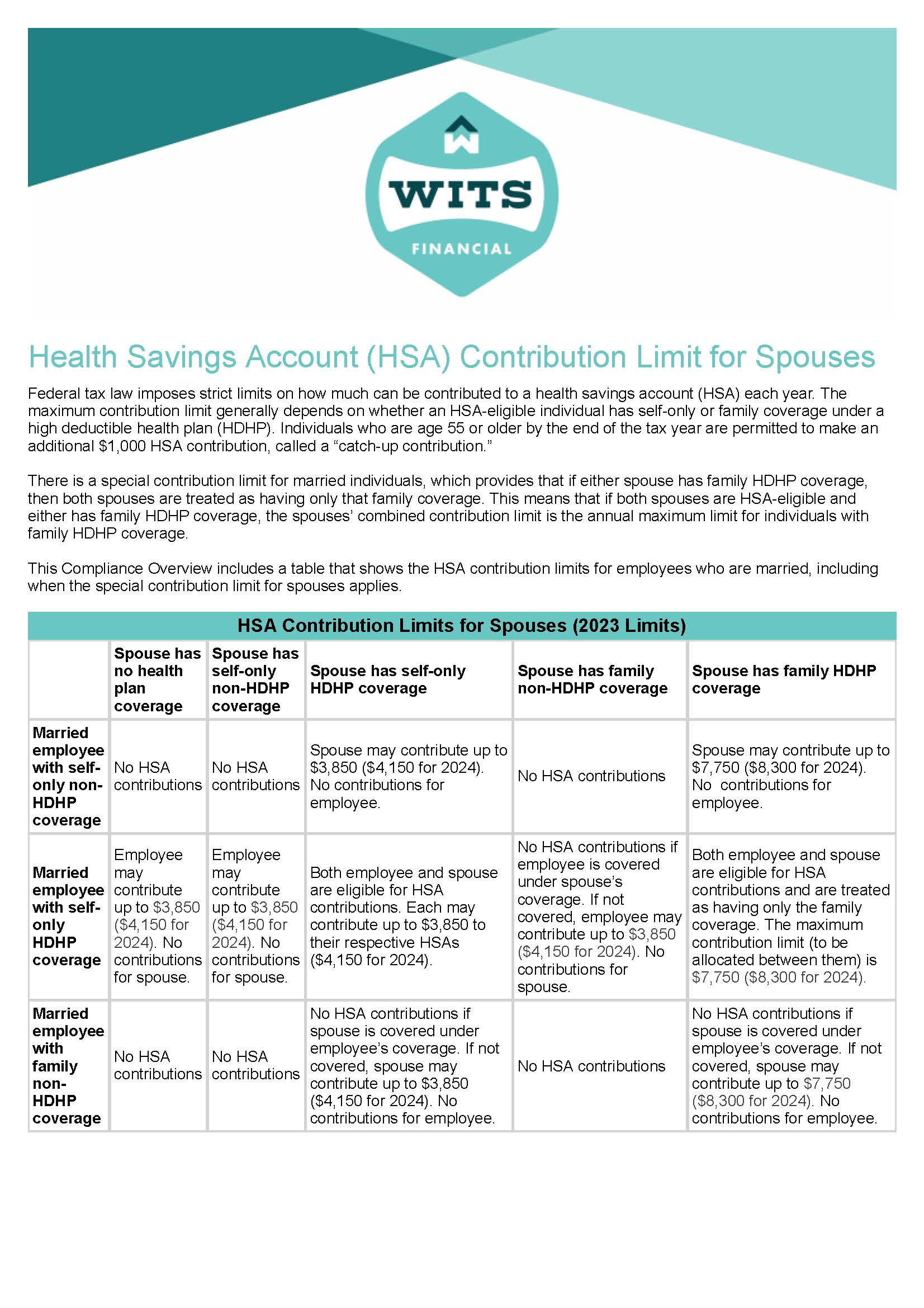

This Compliance Overview includes a table that shows the HSA contribution limits for employees who are married, including when the special contribution limit for spouses applies.

We Make it Easy

Let us take the stress out of managing employee benefits.

Schedule a Call

We’ll ask a few questions, review your current benefits and determine your goals.

Let us Do the Leg Work

Based on your needs and budget, we’ll research all available options and help you select the right plan for your employees and your business.

Bask in the Glory

When you’re confident due diligence has been done, and you’ve selected the right plan it’s time to sit back and relax - or get to everything else on your list.