On May 16, 2023, the IRS released Revenue Procedure 2023-23 to provide the inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs) for 2024. The IRS is required to publish these limits by June 1 of each year.

These limits include:

The maximum HSA contribution limit;

The minimum deductible amount for HDHPs; and

The maximum out-of-pocket expense limit for HDHPs.

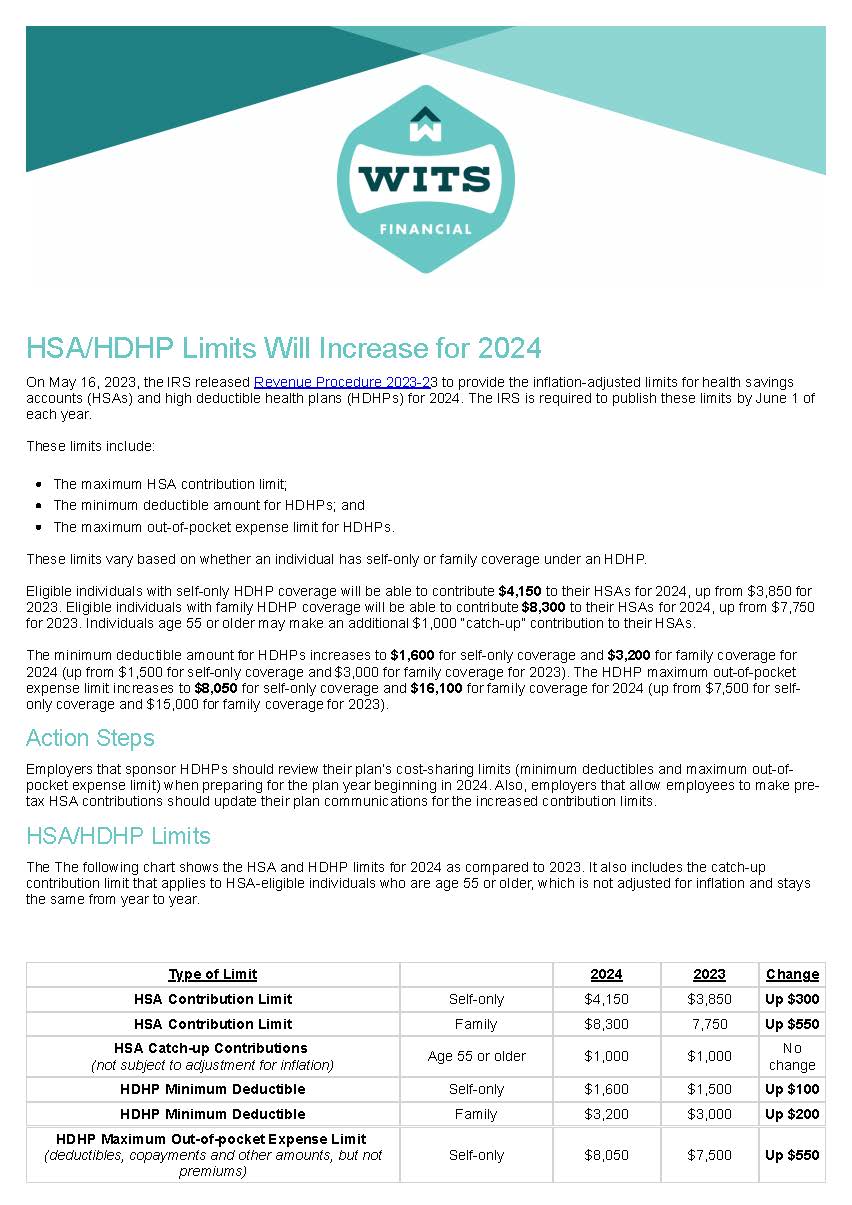

These limits vary based on whether an individual has self-only or family coverage under an HDHP.

Eligible individuals with self-only HDHP coverage will be able to contribute $4,150 to their HSAs for 2024, up from $3,850 for 2023. Eligible individuals with family HDHP coverage will be able to contribute $8,300 to their HSAs for 2024, up from $7,750 for 2023. Individuals age 55 or older may make an additional $1,000 “catch-up” contribution to their HSAs.

The minimum deductible amount for HDHPs increases to $1,600 for self-only coverage and $3,200 for family coverage for2024 (up from $1,500 for self-only coverage and $3,000 for family coverage for 2023). The HDHP maximum out-of-pocket expense limit increases to $8,050 for self-only coverage and $16,100 for family coverage for 2024 (up from $7,500 for self-only coverage and $15,000 for family coverage for 2023).

We Make it Easy

Let us take the stress out of managing employee benefits.

Schedule a Call

We’ll ask a few questions, review your current benefits and determine your goals.

Let us Do the Leg Work

Based on your needs and budget, we’ll research all available options and help you select the right plan for your employees and your business.

Bask in the Glory

When you’re confident due diligence has been done, and you’ve selected the right plan it’s time to sit back and relax - or get to everything else on your list.