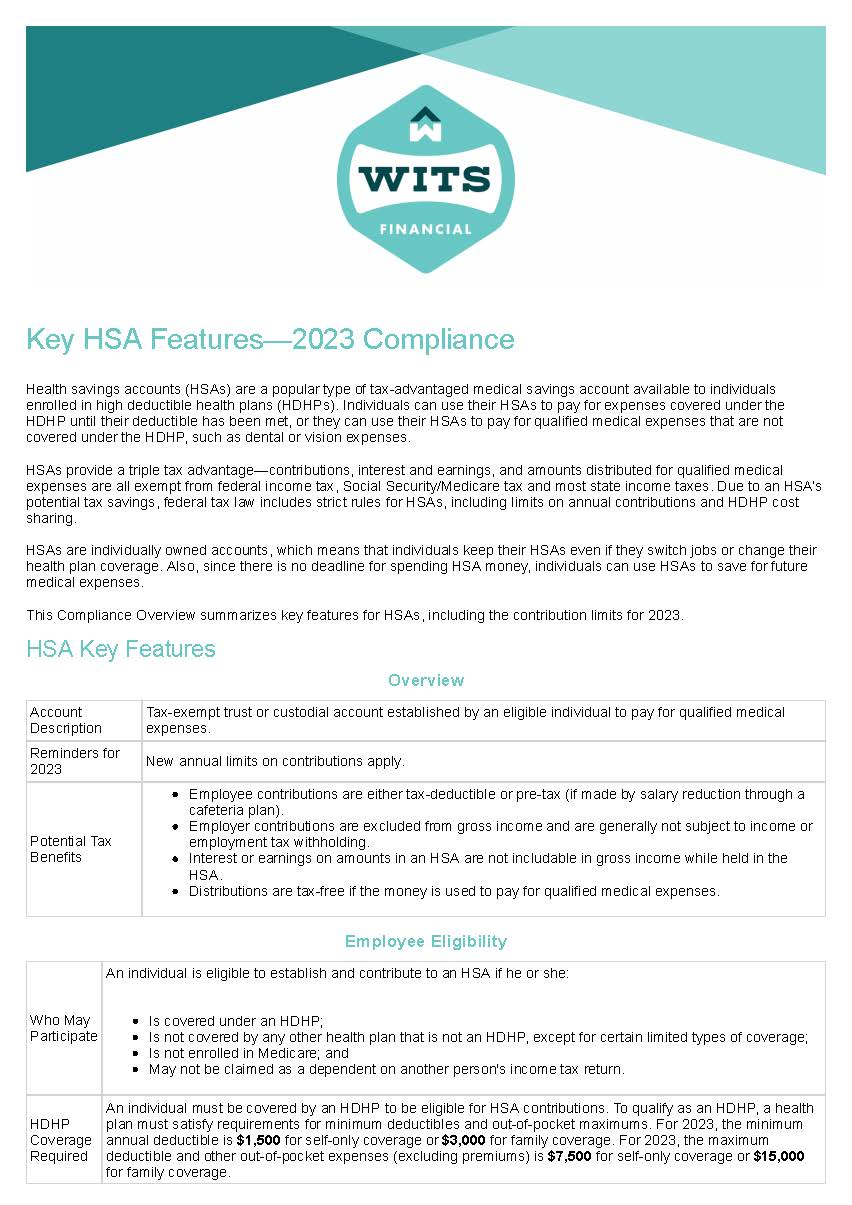

Health savings accounts (HSAs) are a popular type of tax-advantaged medical savings account available to individuals enrolled in high deductible health plans (HDHPs). Individuals can use their HSAs to pay for expenses covered under the HDHP until their deductible has been met, or they can use their HSAs to pay for qualified medical expenses that are not covered under the HDHP, such as dental or vision expenses.

HSAs provide a triple tax advantage—contributions, interest and earnings, and amounts distributed for qualified medical expenses are all exempt from federal income tax, Social Security/Medicare tax and most state income taxes. Due to an HSA’s potential tax savings, federal tax law includes strict rules for HSAs, including limits on annual contributions and HDHP cost sharing.

HSAs are individually owned accounts, which means that individuals keep their HSAs even if they switch jobs or change their health plan coverage. Also, since there is no deadline for spending HSA money, individuals can use HSAs to save for future medical expenses.

This Compliance Overview summarizes key features for HSAs, including the contribution limits for 2023.

We Make it Easy

Let us take the stress out of managing employee benefits.

Schedule a Call

We’ll ask a few questions, review your current benefits and determine your goals.

Let us Do the Leg Work

Based on your needs and budget, we’ll research all available options and help you select the right plan for your employees and your business.

Bask in the Glory

When you’re confident due diligence has been done, and you’ve selected the right plan it’s time to sit back and relax - or get to everything else on your list.