Health reimbursement arrangements (HRAs) are employer-funded accounts that reimburse employees for their eligible out-of-pocket medical expenses on a tax-favored basis. Although HRAs provide significant tax benefits, they are subject to strict plan design rules.

However, a final rule expanded the use of HRAs, effective for plan years beginning on or after Jan. 1, 2020.

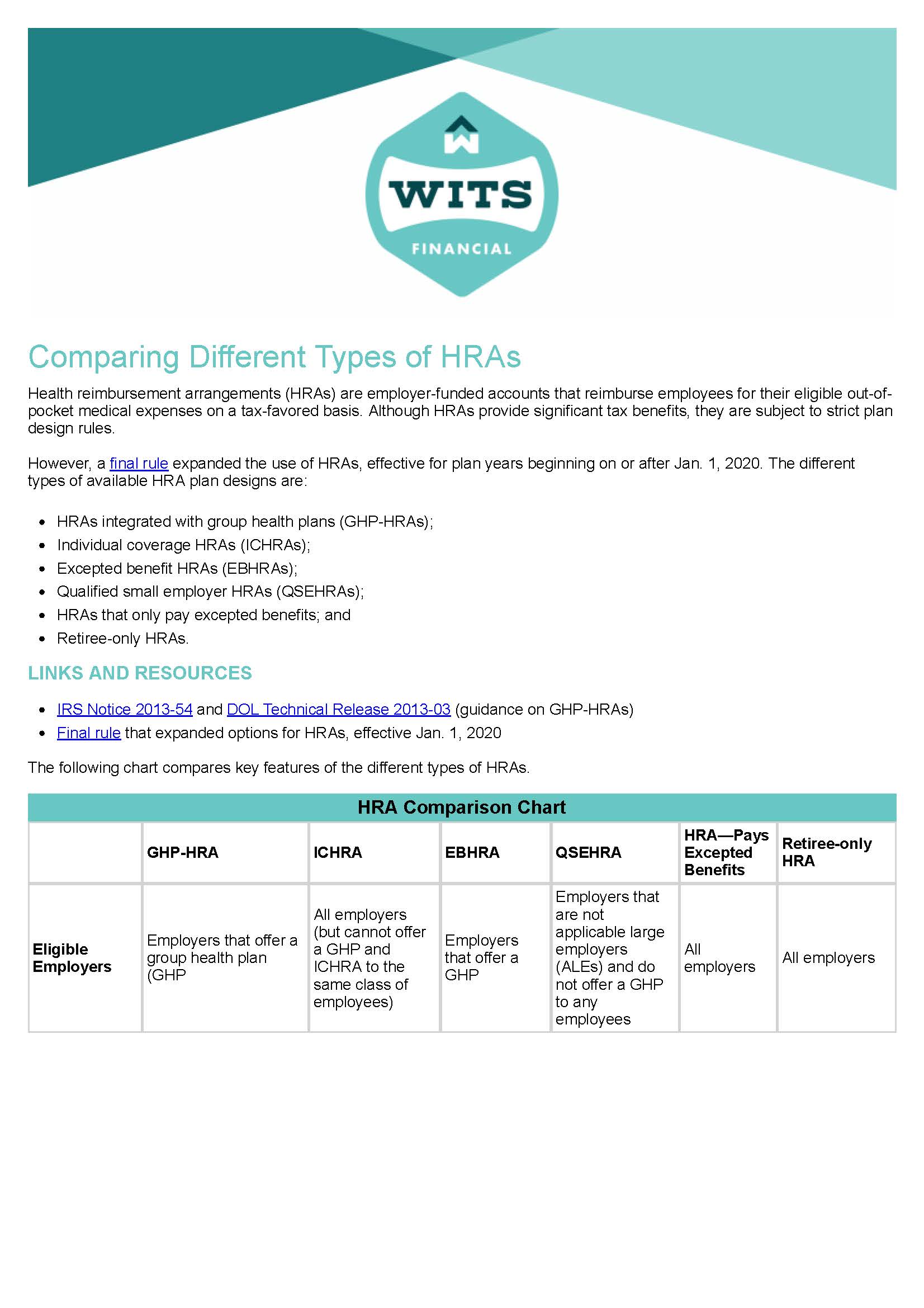

The different types of available HRA plan designs are:

HRAs integrated with group health plans (GHP-HRAs);

Individual coverage HRAs (ICHRAs);

Excepted benefit HRAs (EBHRAs);

Qualified small employer HRAs (QSEHRAs);

HRAs that only pay excepted benefits; and

Retiree-only HRAs.

We Make it Easy

Let us take the stress out of managing employee benefits.

Schedule a Call

We’ll ask a few questions, review your current benefits and determine your goals.

Let us Do the Leg Work

Based on your needs and budget, we’ll research all available options and help you select the right plan for your employees and your business.

Bask in the Glory

When you’re confident due diligence has been done, and you’ve selected the right plan it’s time to sit back and relax - or get to everything else on your list.